“Fix it, no matter what it is broken. Make it better. If necessary, not just the products but also the entire company.– Bill Saporito

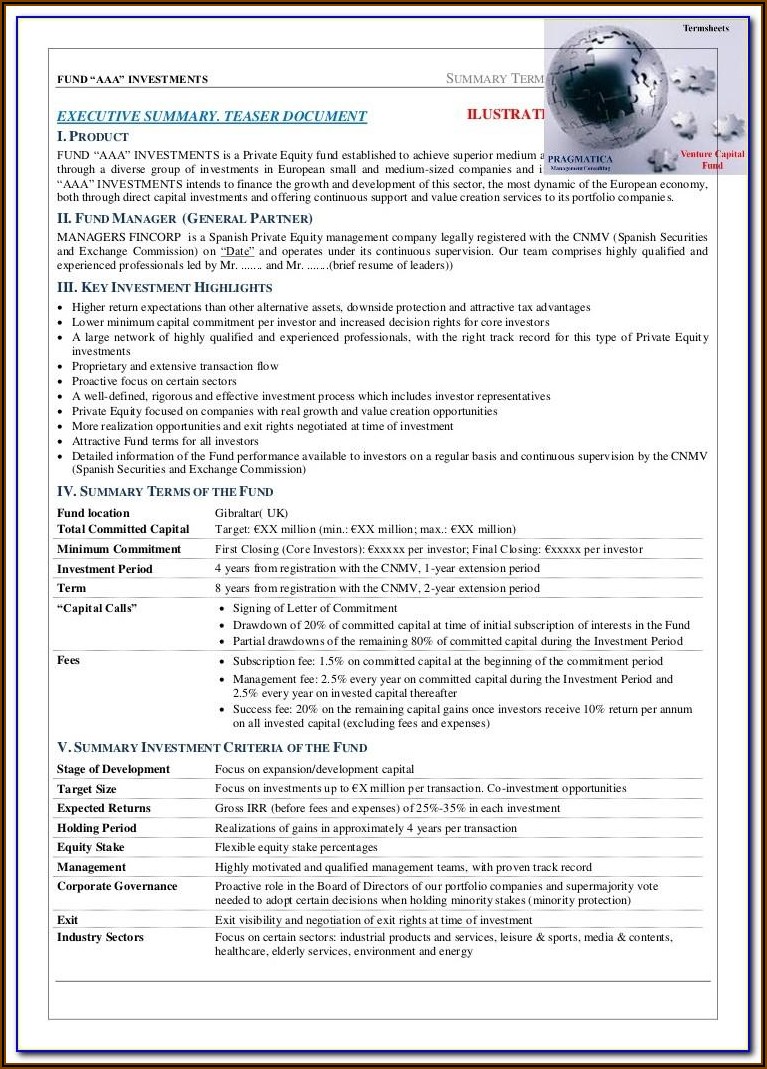

Private Equity firms often overlook the importance of providing an outside perspective to their portfolio companies. This is a key element of value creation. This allows for a business review to be done through a neutral and objective lens. In a highly analytical, fact-based manner that is not affected by cognitive biases of the existing leadership team (e.g. Rationalisation of past decisions, including emotional attachment, mental accounting, endowment effect, mental accounting and status quo, to name a few.

Every company is in business to create value and provide benefits for its stakeholders. While some businesses are able to successfully establish the right value creation path and maintain it over time, others fail. Take a moment to imagine an outside investor looking at your company. What would they find that is missing? How could they add value to your company’s current activities?

1.Rethink the default budgeting mindset of last year.

Re-start the discussion to question vigorously every dollar in an annual budget. This will help build a culture of cost control.

Zero-Based Budgeting (ZBB), is a tool that can be used to find the best return on spending from the bottom up. It gives you a better understanding of cost drivers and categorizes each activity as “must have” (e.g. It is a legal and regulatory requirement, “required” to support differentiating capabilities and “nice to own”. To reduce “nice-to-have” expenses, and to identify nonproductive activities that can be redirected to growth-related activities (e.g. Marketing, sales and M&A.

2.Encourage cash generation.

This begins with tight control of accounts receivables, payable, and an optimization of inventories. It is linked to the previously mentioned scrutinisation of lower-value discretionary expenditures and optimization of high-value spend. This changes the corporate mindset. Managers no longer have to justify why something is the same. Instead, they can start to think about how to improve it. This means a shift from “arguing things in” to “arguing them out”, and the realization that even small changes that save $100,000 each can add up to $10,000,000.

3.Keep a laser-like eye on long-term value-creation.

To create and implement a strategy that positions the company for long term growth and profitability, it is important to make judicious decisions. For example, you need to eliminate low-value activities in order to reap short-term cost savings, and invest in high-potential ideas to generate core value. It is important to take a clear and objective view of the business to determine what core value the company holds, where there is potential for growth, and how to achieve it. Most businesses find it difficult to decide what to stop doing. Cognitive biases like endowment, preference to the status quo or emotional attachment can easily cloud what should be a objective and impartial assessment (e.g. Exiting business lines that do not draw on core strengths of the company and distinguishing capabilities to be developed going forward.

4.Speed is essential..

The PE industry is biased towards action. This can be seen in their 100-day program, which they impose upon portfolio companies within the first few months. This is the time when they are most able to quickly make strategic decisions and implement them. While most businesses don’t have the same freedom as they do with the government, they must balance the need to build consensus and align to drive change. It is also important to recognize that waiting too long to make necessary changes could have a profound impact on the company’s future results.

5.Choose the right team.

PE firms often invest in companies based on the management skills of their leaders. This is because strong and effective leadership teams are crucial to the success of PE firm’s investments. In the first 100 days, one-third of portfolio companies’ CEOs leave. In order to execute a successful strategy, middle managers are more important than ever. Talent management isn’t something to be taken lightly. It is essential to the success of any business.

6.Choose key metrics and set realistic but aggressive goals.

PE firms manage portfolio companies by focusing on a few key areas that are critical to the acquisition company’s success. The PE firms then establish clear, aggressive targets that they will continue to track. While many businesses have some form of performance tracking using key measures, they are often disconnected from long-term value generation. A long-term strategy should include a series of initiatives with clear objectives. These should be used to drive budgets and plans for the year. There is an operational link between strategy and business.

7.Performance and incentives should be aligned.

The base salary of PE firms is modest, but they pay annual bonuses and highly variable bonuses to managers of portfolio companies based on company performance and individual performance. They also offer long-term incentive compensation packages that are tied to exit returns. The fortunes of CEOs, and their leadership teams, are directly tied to their businesses’ performance. They can enjoy a high level of success, but they also suffer when they fail to meet their goals. Bonuses can only be paid when a few aggressive, but realistic, performance targets are met. This is in contrast to bonuses at most businesses which are an expected part or overall compensation regardless of performance. A tighter relationship between performance and pay, especially over the long-term, is a way to reward top talent and encourage a culture of high-performance.

While PE firms have a lot of advantages in building high-growth, efficient businesses, some of their best practices can be applied to many other companies.