Outsourced Freight

Large Transportation Companies are often lying when they promise that their product will never leave their fleet of trucks. All trucking companies use the well-known and widely used strategy of building partnerships in Freight movement. FedEx is a mega shipping giant. I have worked for FedEx for nearly 15 years and learned that they can use outsourcing to their benefit. This is called “maximizing resources” for the carrier to accomplish their job.

They don’t have to send their trucks to Lake City, Colorado when they have an agent network who would charge them almost nothing compared to the cost of their own trucks for delivery. Although shippers don’t like the thought of their freight being delivered by another company than they contracted with, this is what we live in. This process is seen by shippers as an opportunity to lose, damage, delay transit times, and theft. You can only ask for honesty and integrity from your carrier and to be aware of the contractor’s identity as a shipper. My shippers always hear me say to them: Stay informed, proactive, and alert. Ask those questions.

Get More Bang for Your Buck

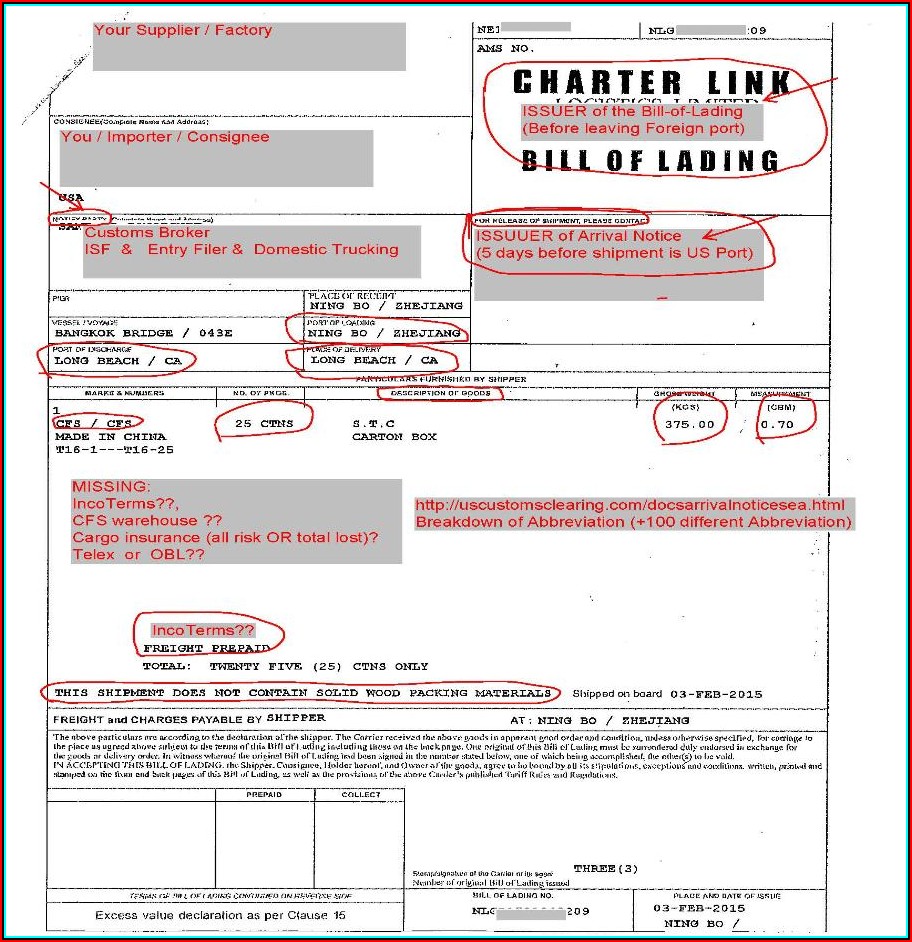

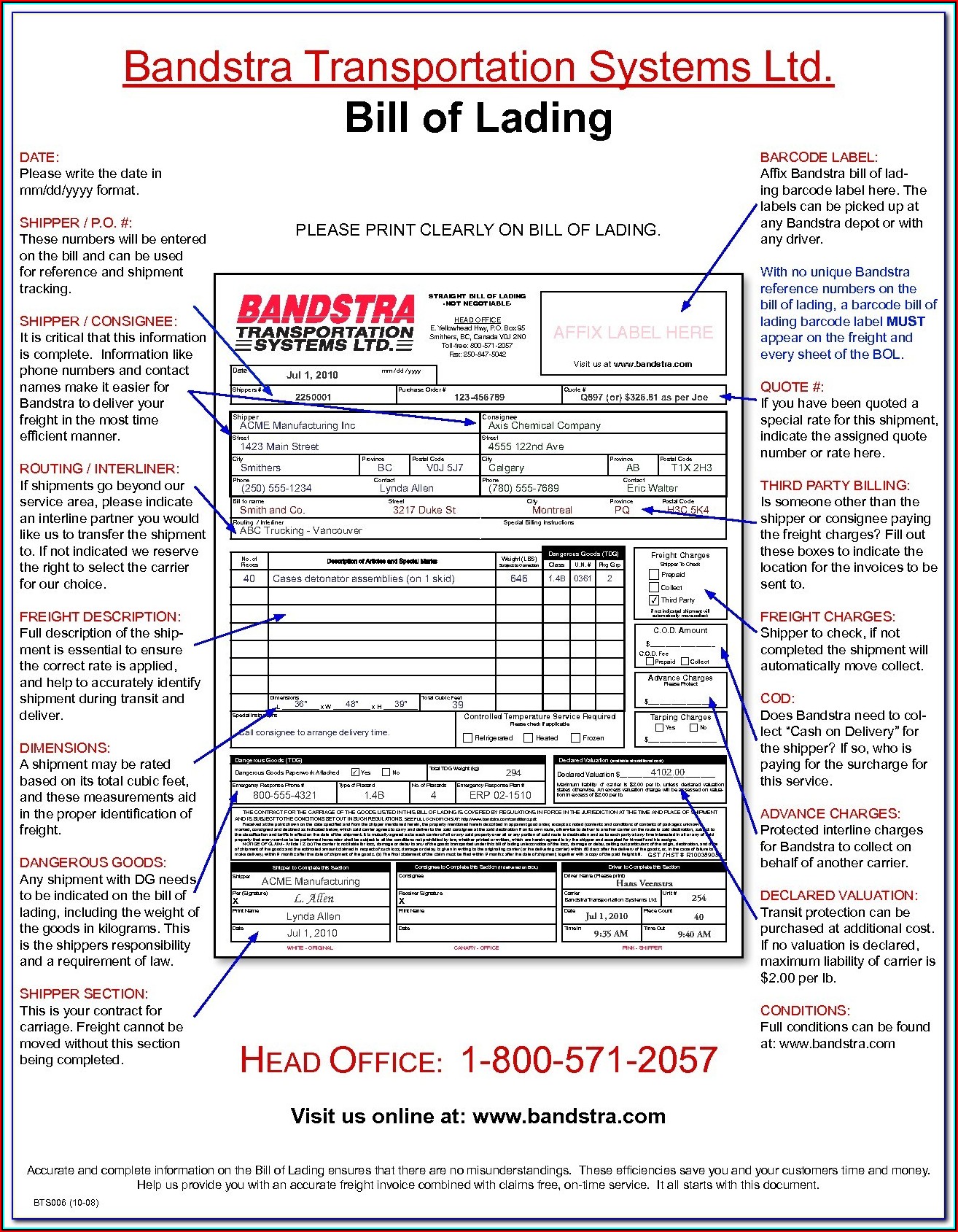

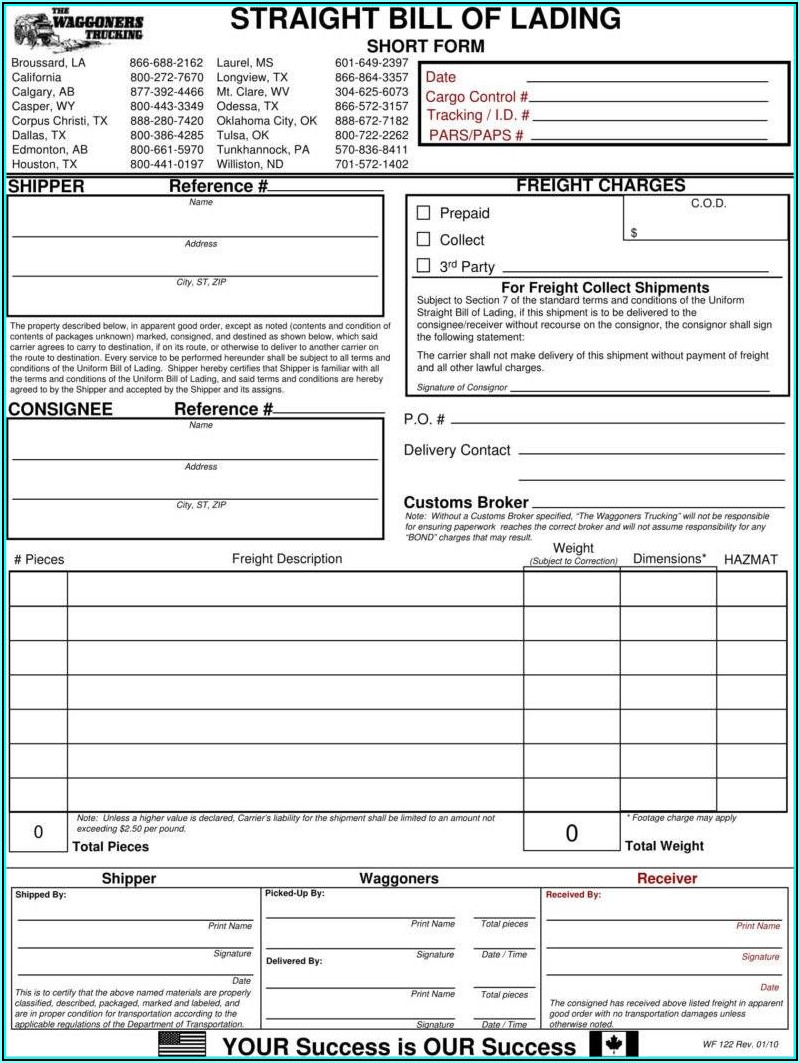

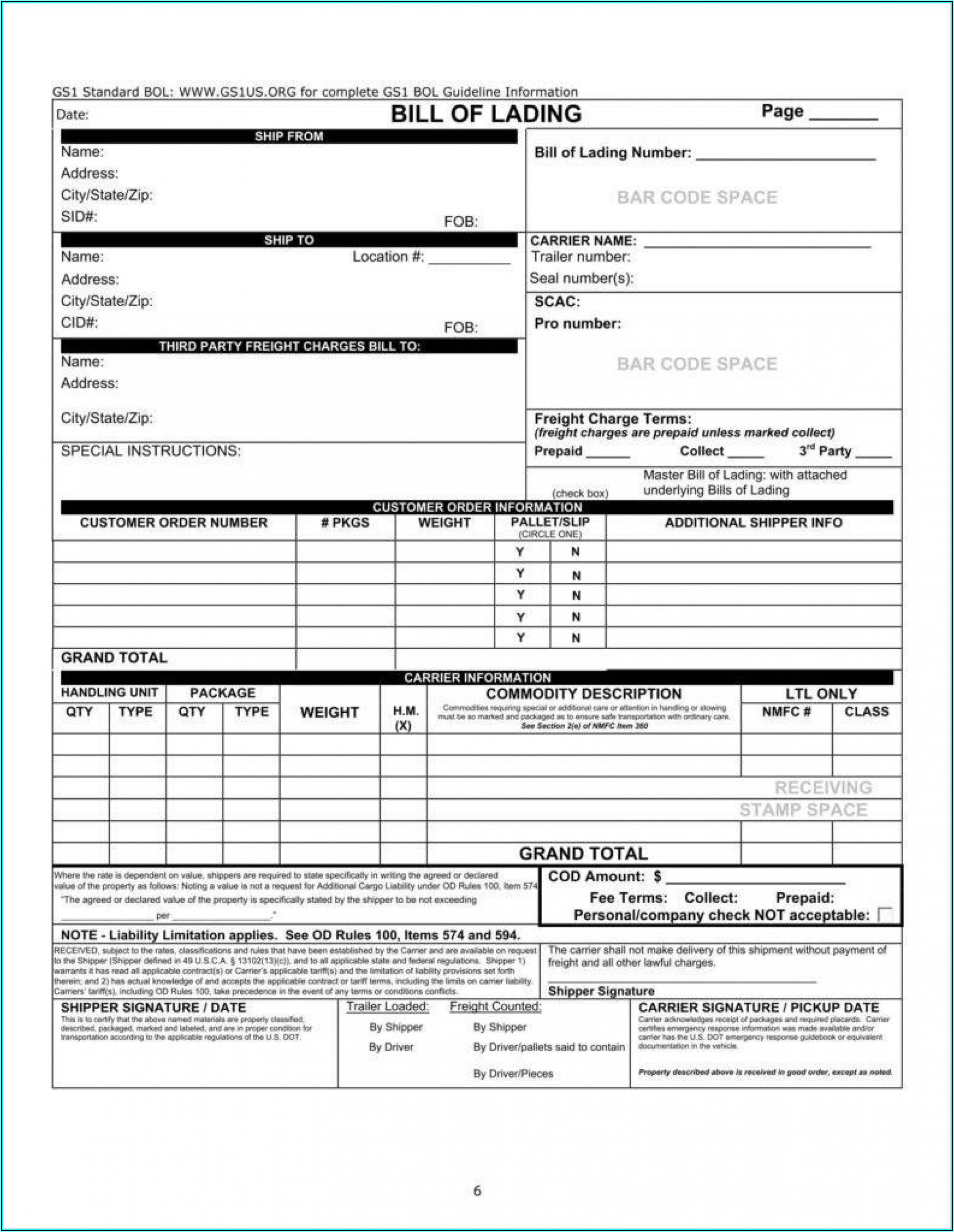

Many shippers have written “Don’t double stack my freight” on their bills of ladings and packages. But the truth is that if your freight’s density and flat enough, it will be double-stacked. Terminal managers in the industry are trained to maximize their trucks until an “ant won’t be able breathe.” Your freight will be stacked if you do this. Customers have begun to attach small plastic cones to their packages. This would indicate that the carrier removed or stacked the cone from the box in order for them to load additional packages. You can request that the carrier use a “stacking board” if you have a product sensitive to stacking. This will enable the carrier to stack your freight, protect it, and offer you a great rate.

Cash Cow

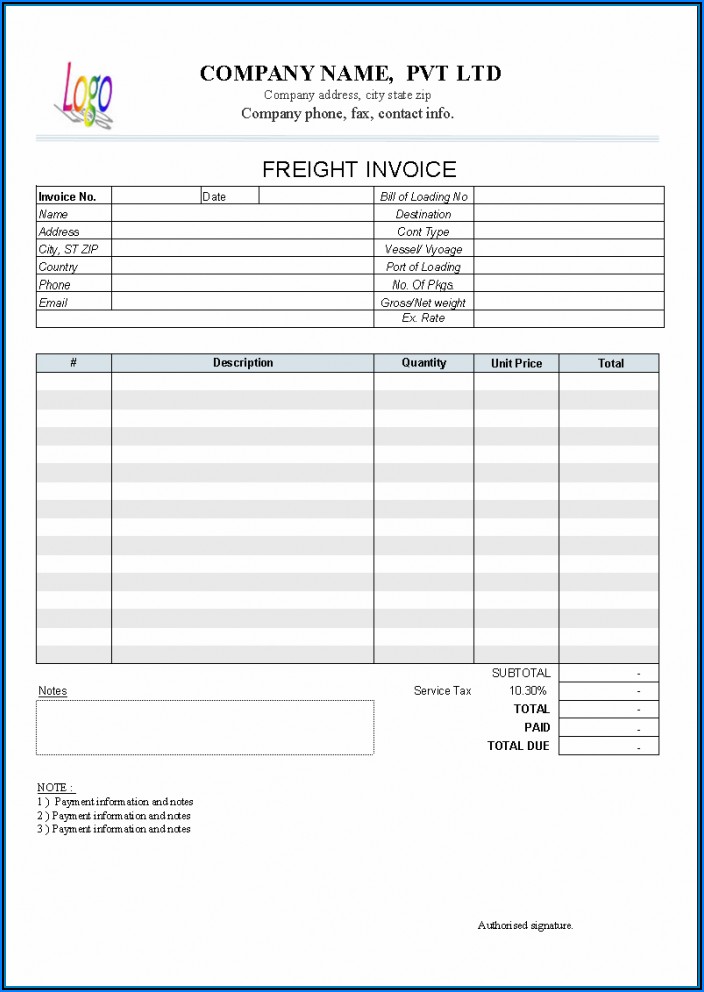

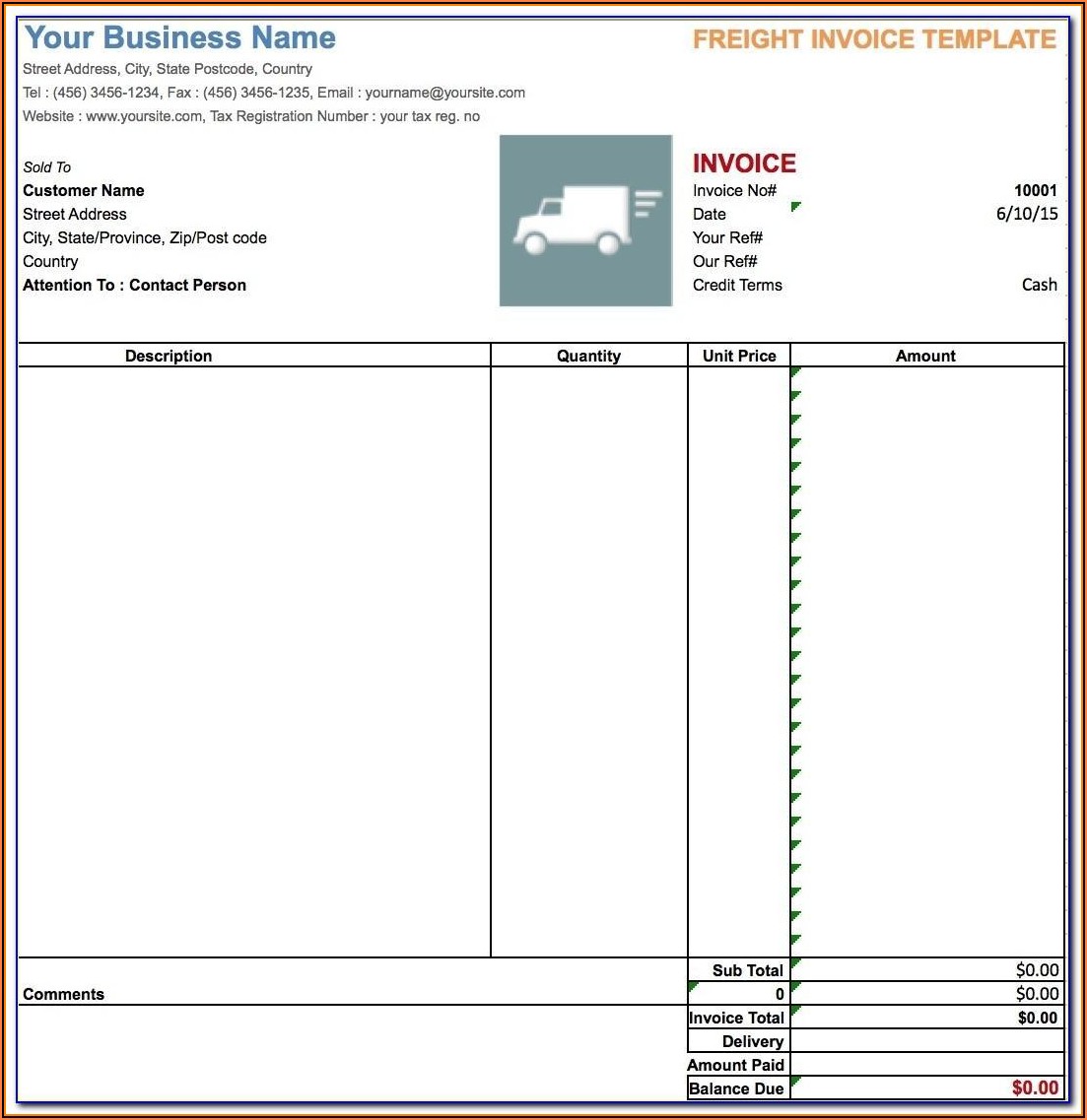

Freight is worth $240 billion. Carriers know how to maximize their profits. Although it is true that carriers used to be more strict about “not reweighing” their shipments at one time, there has been an increase in the Freight Industry’s belief that “if in doubt, reweigh.” All shipments that pass through their warehouse are being weighed by carriers. Shippers need to be aware of this and not just try to get one shipment from them. This aspect of shippers’ business has been referred to by carriers as a CASH COW. The carrier reweighs customer shipments every year, saving millions of dollars each year.

Shippers, don’t be crazy, you must be smart. This is the time to learn about shipping and not try to do it quickly. Without guessing, enter the correct weight for your shipment. Buy a scale if you don’t already have one. Depending on your needs, scales can cost anywhere from $600.00 to $15500.00. Shipping companies are often reluctant to spend this much money on a scale when they don’t know the product’s weight. Remember that manufacturers make mistakes and are human beings. It is impossible to guarantee that your product will weigh exactly as specified. You can spend the money on the scale and become more efficient in your supply chain. Do what it takes to calibrate a scale you suspect is not calibrated.

Re-bills

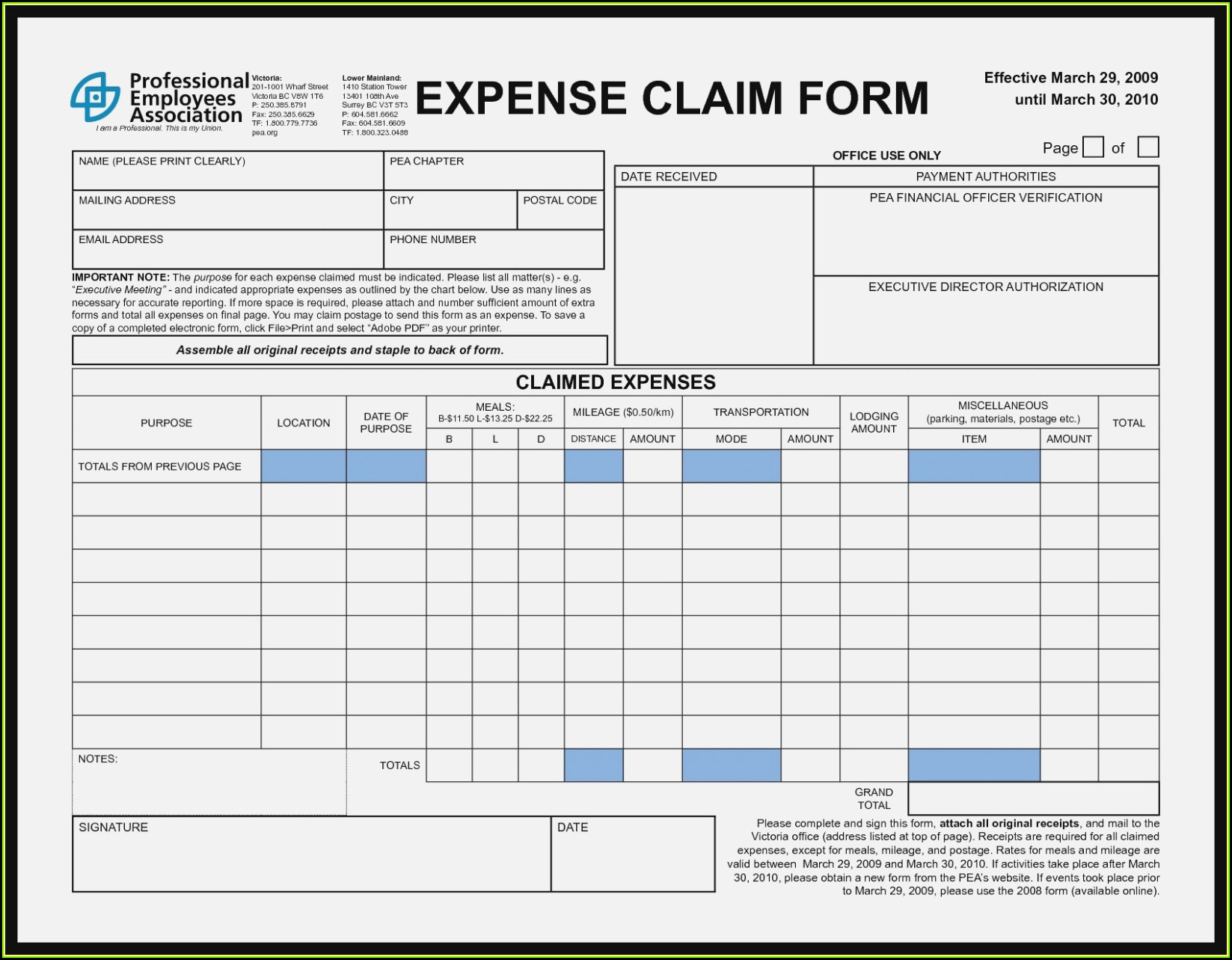

You need to understand the freight classification for any product you ship freight. The re-bill is also an option. This is something I won’t get into too much detail about, but Carriers make money from customer’s reweighs just as they do with rebills. Carriers know that shippers don’t understand the NMFC codes and probably don’t care. They are then required to pay $100 more for each shipment that leaves their warehouse.

The customer initially thought they would make a little profit but after being re-billed, they lose money. Shippers can fall prey to poor planning, inefficiency, and lack of proactive education about these rules. The internet is available to all, so there is no reason why Warehouse Managers or Ops Managers can’t become more knowledgeable about these rules and regulations. Shippers should be aware that Carriers have employees who are solely responsible for monitoring weights and rebills. Anything that can be reclassified will be.

Carrier Loyalty

Although I strongly believe in value and not shopping based only on price, I must admit that I have encountered many customers who were misled by their “dedicated carrier”. I think it’s wonderful to have a strong relationship. Wake up, people. I have some bad news for those who have worked with one main carrier for many years and whose sales rep has only kept you satisfied with pizza. It’s possible that you are being scammed somewhere. I’d bet a nickel that it’s in your pocket. Many shippers fall for what I call “The Freight Halo Effect”, which is when a carrier begins to feel a false sense security after building rapport with his customer.

The freight company ceases to review their customers’ spend and follow up on shipments. Customers who have been using their carriers for years have not done a freight analysis. My clients tell me to “Take the slow time” of their business to see how freight spend is correlated with last year’s spend. It’s often not just one aspect that is causing high prices, but many other factors are also involved.

Low-Cost Providers

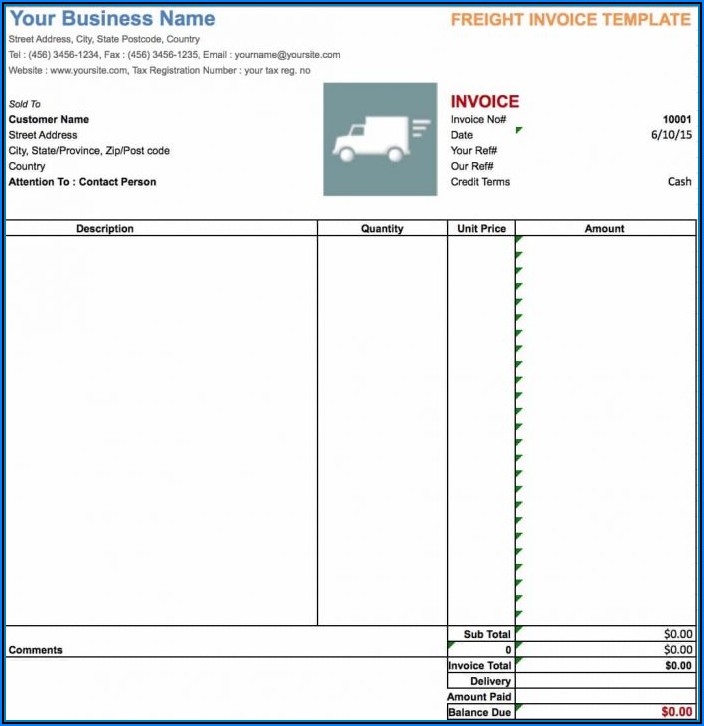

Many carriers offer cheap rates, pizzas and pens, as well as calendars. What can I do for your business? They are ready and eager to get started. When you hand them your first shipment, it goes wrong and suddenly they are gone. This is common with Freight Sales Representatives in the Industry. They often lose their jobs because they have overpromised or don’t understand the business model of their customers.

Your Sales Representative should not only give you solid rates but also answer those crucial questions. Is he aware of what could happen to your company if your product that was due to arrive in Gainsville on Friday, didn’t make it there? Is he aware of the actual cost to your company? In dollars? Customer loyalty? Is he able to properly position your product so that there is no reclassification of reweighs? Is he a business owner or a sales representative looking for new business? You need to make sure that they really understand your business and can not only provide you with competitive rates but also understand the needs of your supply chain.

Transit Times

Over the years, this has been a problem for shippers. You are given marketing literature by your sales representative. It clearly states that the transit time from Los Angeles to Dallas is 3-4 days. Your customer (Shipper), promises you it will arrive in four days. You get a call from your customer (Consignee), 6 days later, and guess what? You don’t have any product. You become furious and upset at your representative. Naturally, the rep hides. The Standard Transit Time that you see on marketing brochures is only an approximate. This information is important for shippers.

In the past 10-15 years, freight companies did not offer guaranteed services. However, companies like Yellow and Conway Freight quickly realized the potential for profit and the opportunity it represented. As a shipper, here are some questions to ask your freight rep. Do they hold freight for building a load or do they push freight out as soon they get it? (The ladder is very rare in today’s shipping industry). Are they able to track freight on-line? Freight companies often send freight out on specific days of the week. Shippers who have specific states they are shipping freight to should ask their sales representative which days of the week they ship freight. You must challenge your Representative with professionalism and education.

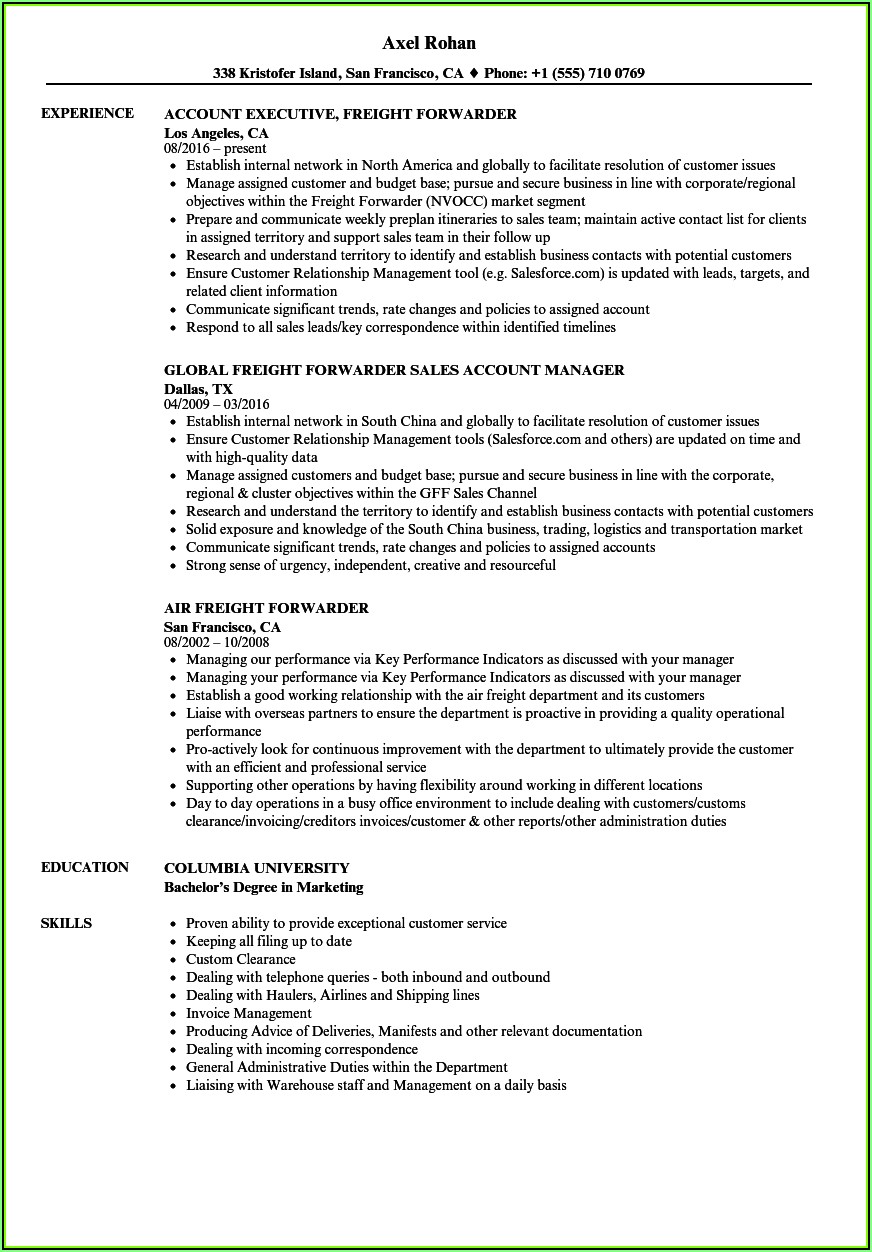

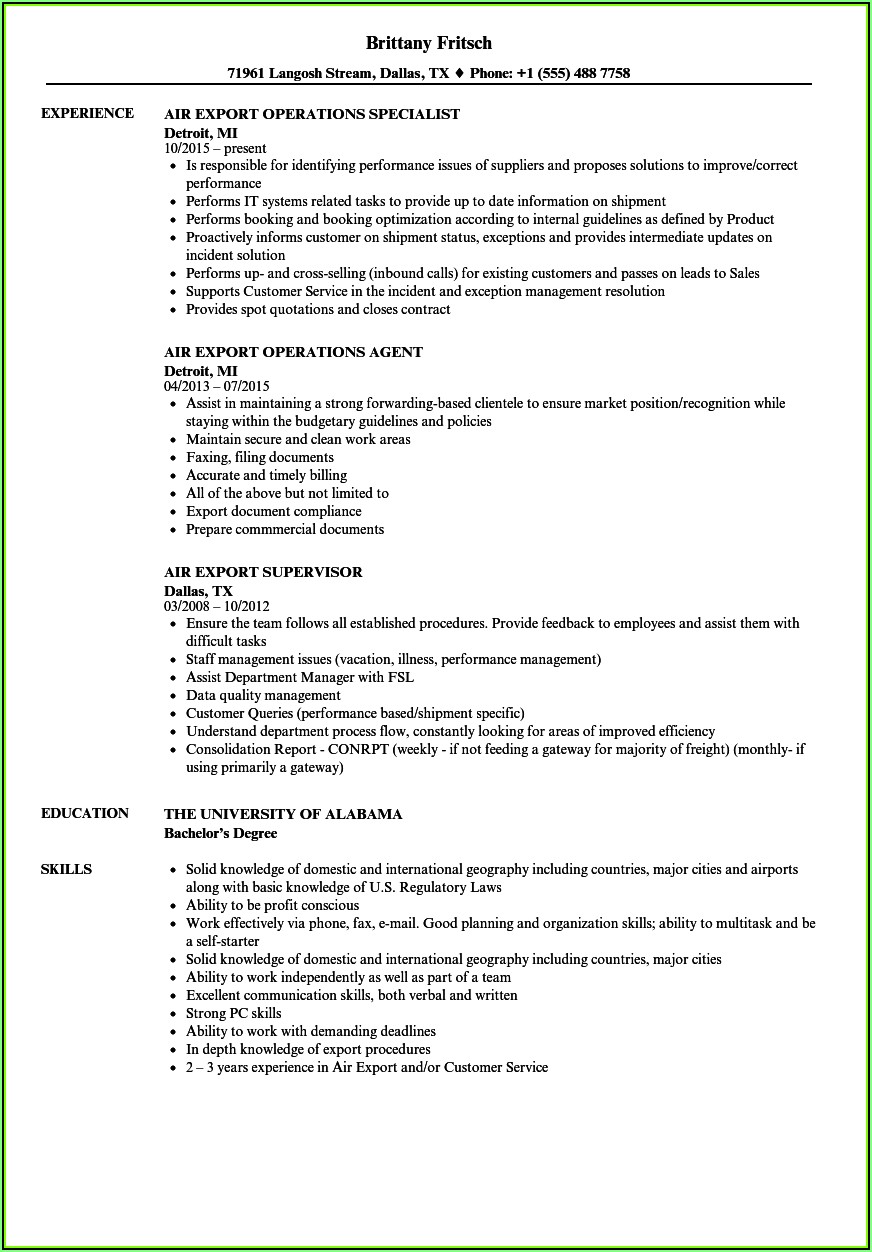

Earl White is a National Manager at One Stop Logistics, a Third Party Logistics company, based in Watsonville, Ca. His experience in sales spans over 15 years. He works with many sales representatives to help them get better footing when it is time to work with clients. He loves being able pass on the many skills he learned from top salesmen in the industry.